Lower Losses Increase Profitability

Cut Incident Rates by More Than 70% in Just 3 Months

Intelligent Risk Management at Scale

Transform your portfolio in 90 days. Manage risk across

thousands of vehicles with immediate impact.

Boost profitability

Accenga slashes accident rates

- Advanced analytics cut accident frequency and severity

- Result: Lower claims costs, improved loss ratios

- Why it matters: Your bottom line improves as fleet customers get safer

AI-powered risk monitoring transforms portfolio management

- Real-time analysis of telematics and video data

- Spot risk patterns and improvement opportunities instantly

- Impact: Make data-driven decisions to optimize your customer portfolio

Happier customers, higher renewal rates

- Help fleets enhance safety and cut costs

- Outcome: Increased customer satisfaction

- Bottom line: Higher retention and more renewals

Slash Rising Claim Costs Now

Your secret weapon against commercial auto risk

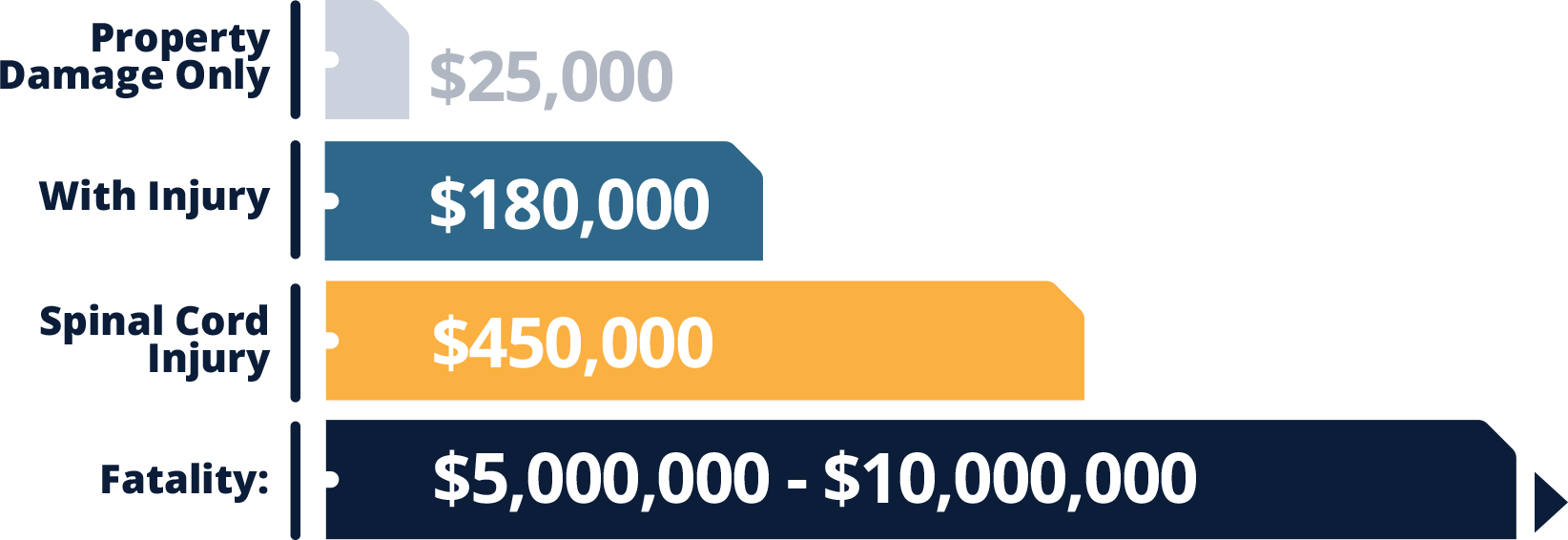

The True Cost of Claims

In today’s volatile market, these escalating costs directly impact your loss ratios and profitability. Accenga provides the tools to help your insureds mitigate these risks, protecting both their operations and your bottom line.

How It Works

Manage the risk within your portfolio at scale

Develop performance KPIs per fleets / per driver

Ongoing risk monitoring and Active engagement with insured

Reduce losses/accidents increase profitability

Beat Rising Costs with Proactive Risk Management

Premiums and litigation costs are skyrocketing. Act now.

Our solutions spot high-risk drivers before claims happen. You’ll provide

better service, price more accurately, and slash claim frequency.

Next-Gen Data Analysis Transforms Risk Assessment

We’re not just telematics. We’re your risk crystal ball.

Accenga analyzes all events data types and driver behaviors. Result: 24×7

risk change monitoring and laser-focused interventions 365 days a year.

Want to cut losses and boost profits?

Insurance Product

Engage

Scalable active risk management, engagement and accountability software solution reducing losses in an insurance company’s commercial auto book of business

- Agency Data and Telematics Data Management

- Active Risk Monitoring (Portfolio Level)

- Ongoing KPI based Management

- Daily / Weekly / Monthly Engagement

- Exception Engagement

- Customized Reporting

- Data Quality Monitoring

- Portfolio / Manager level Monitoring and Reporting

- Producer / Risk Manager Engagement

- Active Risk Monitoring and Engagement

- Pro-Active Escalation

- Fleet Risk Monitoring and Engagement

Contact required info@accenga.com for more details and pricing.

Stand Out and Stay Safe

Lead the Pack in Fleet Risk Management

Attract Top-Tier Fleets, Outshine Competitors

Offer Accenga: Win safer clients. Build a lower-risk portfolio. Become the go-to insurer for safety-conscious fleets.

Ride the Wave of Innovation

Stay ahead with cutting-edge fleet tech. Position your company as the forward-thinking choice in transportation insurance.

Master Dynamic Risk Landscapes

Tackle high driver turnover (35-120% per policy period). Monitor risk continuously. Adapt in real-time to changing fleet compositions.